As 2025 unfolds, India is grappling with a market crisis driven by economic slowdown, stock market volatility, currency depreciation, and rising inflation. This downturn has raised concerns among investors, businesses, and policymakers about the nation’s financial stability and future growth prospects.

In this blog, we will analyze the key factors behind India’s market crisis, its impact on various sectors, and the potential measures to overcome these challenges.

1. Economic Slowdown: A Warning Sign

India’s GDP growth has decelerated significantly, with estimates showing a drop to 5.4% in the July-September 2024 quarter—the lowest in seven quarters. Factors such as weak consumer demand, global economic uncertainty, and inflationary pressures have contributed to this slowdown.

Key Reasons for the Slowdown:

- Declining Urban Spending: Consumers are spending less due to high inflation and job uncertainties.

- Industrial Production Slowdown: Manufacturing and service sectors are experiencing weaker growth.

- Global Trade Tensions: The U.S.-China trade war and disruptions in global supply chains have affected Indian exports.

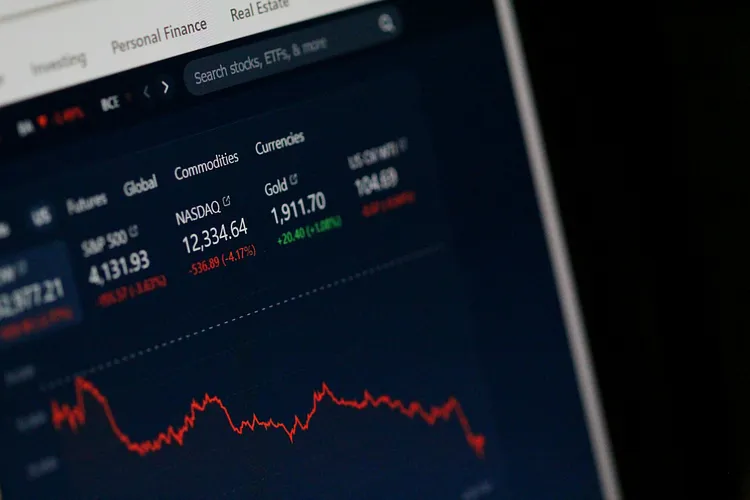

2. Stock Market Volatility: Investors on Edge

The Indian stock market has been highly volatile in 2025, with the Sensex falling over 4,000 points in February and the Nifty 50 experiencing its longest losing streak since 1996. This decline has shaken investor confidence, leading to panic selling and capital outflows.

Major Concerns for Investors:

- Uncertainty in Global Markets: Fluctuations in U.S. interest rates and geopolitical tensions have increased market instability.

- Withdrawal of Foreign Investments: Foreign Institutional Investors (FIIs) have pulled billions from Indian equities.

- Weak Performance of Banking & IT Sectors: Leading companies in these sectors have reported lower-than-expected earnings.

Experts advise investors to adopt a long-term approach and focus on fundamentally strong stocks despite the short-term volatility.

3. Currency Depreciation: Rupee Hits Record Lows

The Indian rupee has been facing significant depreciation pressures, with projections indicating a fall to ₹87.88 per U.S. dollar within three months and ₹88.30 by February 2026. This depreciation is primarily driven by:

- Trade Deficit Widening: India’s import bills are rising, particularly in crude oil and essential commodities.

- Weak Economic Growth: Slow GDP growth has led to reduced confidence in the rupee.

- Global Interest Rate Hikes: The U.S. Federal Reserve’s tight monetary policy has strengthened the dollar against emerging market currencies.

A weaker rupee increases the cost of imports, making fuel, electronics, and foreign education more expensive for Indian consumers.

4. Rising Inflation & Protectionism: A Double Blow

India has been struggling with high inflation, affecting both businesses and households. Additionally, protectionist trade policies worldwide have disrupted supply chains and increased import costs.

Factors Driving Inflation:

- Surging Commodity Prices: Food and fuel prices remain elevated.

- Supply Chain Disruptions: Delays in global shipments have raised costs.

- Government Spending Pressures: Rising public debt and fiscal deficit have fueled inflationary trends.

Economists warn that persistent inflation could hurt economic recovery by reducing consumer purchasing power and forcing the RBI to maintain high-interest rates.

5. Government’s Response: Policy Measures & Economic Reforms

The Indian government has taken several steps to tackle the ongoing crisis:

Key Policy Actions:

✔️ Regulatory Appointments: New financial regulators have been appointed to drive economic growth, though concerns over regulatory independence remain.

✔️ Union Budget 2025: The government has introduced tax cuts, infrastructure spending, and incentives for startups to boost growth.

✔️ Economic Survey Recommendations: Policy focus on deregulation, infrastructure development, and renewable energy investments.

However, analysts argue that structural reforms and long-term policy stability are needed to restore market confidence.

6. The Road to Recovery: What Lies Ahead?

Despite the current crisis, India has strong economic fundamentals that can support recovery. Experts suggest the following strategies to revive growth:

1️⃣ Monetary Policy Adjustments

The Reserve Bank of India (RBI) may need to adopt a balanced approach to monetary policy—ensuring inflation control while supporting credit growth.

2️⃣ Structural Reforms

Reforms in banking, labor laws, and ease of doing business will enhance productivity and attract foreign investment.

3️⃣ Boosting Domestic Demand

Encouraging local manufacturing and increasing consumer purchasing power through tax incentives and employment programs.

4️⃣ Strengthening Global Trade Partnerships

India must diversify trade relations and reduce dependency on major economies like the U.S. and China by exploring new markets in Africa, Latin America, and Southeast Asia.

Final Thoughts

India’s market crisis in 2025 presents serious challenges, but it also offers an opportunity for bold economic reforms and policy corrections. While short-term pain is inevitable, strategic decision-making and long-term investments in critical sectors can help India emerge stronger.

🔹 Investors should focus on resilience, diversification, and value-based investing.

🔹 Businesses must innovate and adapt to changing global economic conditions.

🔹 Policymakers should implement reforms that enhance India’s global competitiveness.

India has overcome crises in the past, and with strong governance and economic resilience, the country can navigate this downturn and return to a sustainable growth trajectory.

What are your thoughts on India’s economic situation in 2025? Let’s discuss in the comments below!