Canada Post Bleeds Federal Reserve: Fed Loans $1034 Billion Inspite of Canada Post Loosing 208 Million Due to Strike

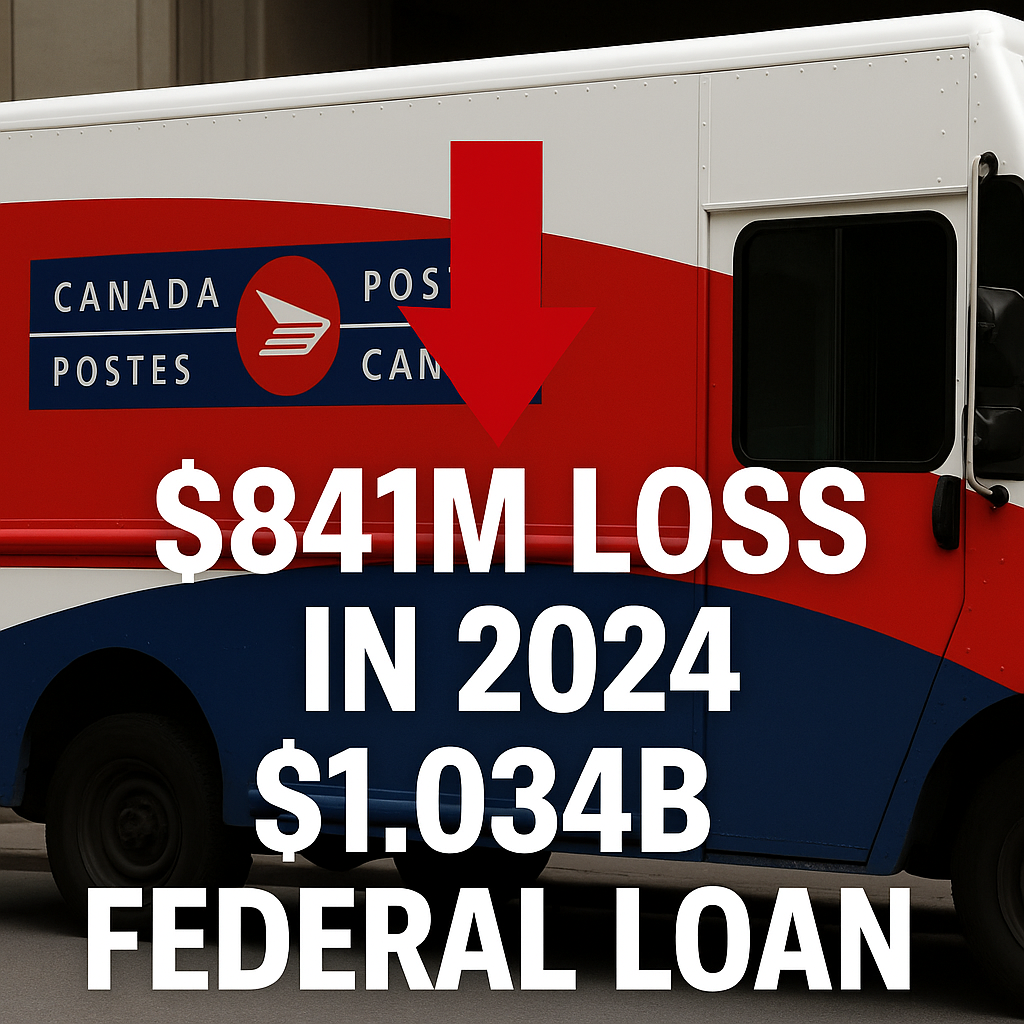

Toronto – In 2024, Canada Post recorded a loss before tax of CAD 841 million. Its operating loss (excluding non-recurring items) in 2024 was nearly CAD 1.3 billion. The 2024 loss was worse than 2023’s, which stood at CAD 748 million before tax. Over the period 2018–2024, Canada Post has accumulated more than CAD 3.8 billion in losses (before tax).

For the third quarter of 2024 alone, Canada Post posted a loss before tax of CAD 315 million. In Q2 2025 (April–June), Canada Post reportedly recorded a loss before tax of CAD 407 million, which was the largest quarterly loss in its history.

From what Canada Post itself and analysts identify, several underlying causes contribute to the persistent losses. Letter mail and transactional mail (bills, statements, etc.) continue to shrink as more communication and billing moves digital. Parcel business (which had been a growth area) has faced strong competition from private courier/internet delivery services.

In 2024, parcels revenue declined by 20.3% and volumes by ~19.9%. The 2024 national strike further depressed parcel volumes and revenue. A 32-day national strike in late 2024 was estimated to have negatively impacted Canada Post’s loss by CAD 208 million. Because operations were shut during the strike, revenue fell more steeply than costs.

Canada Post argues that its existing regulatory framework, labor agreements, and policy constraints limit its ability to modernize, adjust operations (e.g. delivery models), and respond flexibly to market changes. Ongoing losses have eroded cash reserves.

As of end-2024, Canada Post had loans/borrowings near CAD 1 billion, with CAD 500 million due in July 2025. Without additional funding or restructuring, the company warned it would fall below operating cash requirements by mid-2025.

Canada Post divested its SCI Group Inc. and Innovapost Inc. in 2024. These divestitures generated gains and dividend income that partially offset losses, but do not alter the underlying operational deficits. When excluding non-recurring gains, the “pure” operational losses are larger.

To prevent insolvency and keep the postal service operating, the Government of Canada announced that it would make available up to CAD 1.034 billion in repayable funding in the 2025–26 fiscal year. However, this funding is seen as a bridge / temporary measure, not a fix to structural challenges.

CK Sharma

Editor in Chief – Newsbee

Toronto